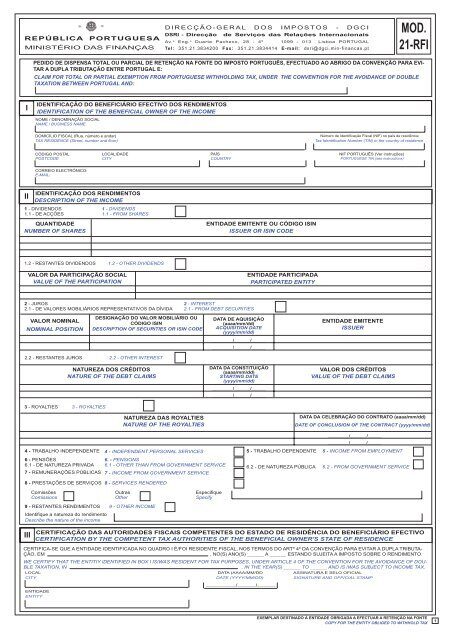

What is the RFI 21?

It is a Double Taxation Convention document, used when there are incomes from countries other than the country of residence.

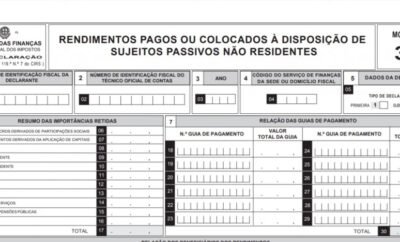

Taxpayers residing in Portugal but earning income abroad are required to pay tax, at the applicable rates, in the country where these incomes are paid. However, they must also be paid in Portugal because the taxpayer has their residence or tax domicile in this territory.

To avoid paying tax twice on the same income for taxpayers in these situations, conventions have been established between various countries.

Thus, if the income is earned in a country with which Portugal has a convention to avoid double taxation, the withholding rates are lower, or there may even be an exemption from withholding.

In the case of Local Accommodation (AL), platforms without residence in Portugal must provide this document to the AL owner.