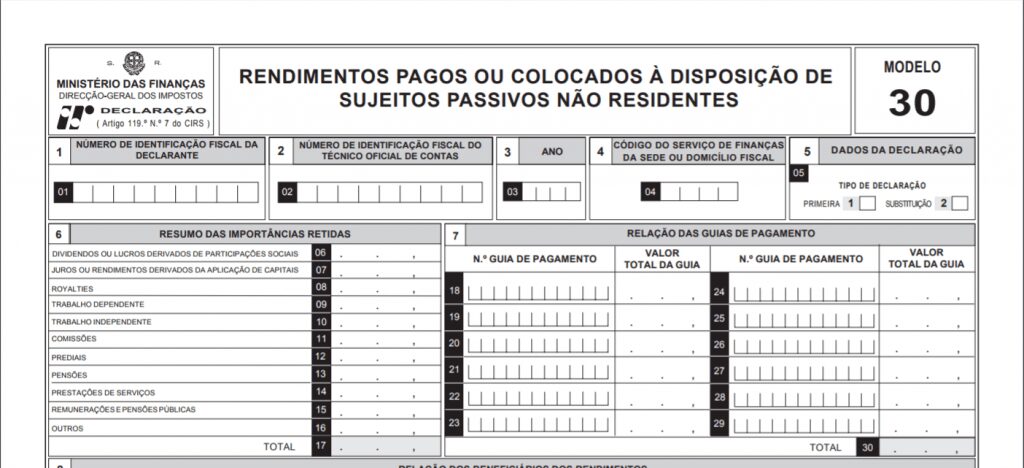

Managing Form 30 for Local Accommodation Owners in Portugal

For proprietors of Local Accommodation (AL) in Portugal, navigating the complexities of tax obligations, especially when dealing with international platforms like Booking or Airbnb, can be daunting. A crucial aspect of this process involves the submission of Form 30, a requirement that many AL owners may not be fully aware of. This blog post aims to shed light on the necessity of Form 30, its submission process, and how to correctly fill it out.

Understanding the Obligation of Form 30

If you’re an AL owner advertising your property on platforms whose fiscal residence is outside Portugal and you pay commissions to these platforms for bookings, you’re required to submit Form 30 related to these commissions. This form is a critical component of your tax obligations, ensuring compliance with Portuguese tax laws.

When to Submit Form 30

The deadline for submitting Form 30 is stringent. You must submit the form by the end of the second month following the one in which the platform issues the commission invoice. This timeline is crucial to avoid any penalties or late fees associated with delayed submissions.

Step-by-Step Guide to Filling Out Form 30

Filling out Form 30 might seem complex, but with the right information, it can be a straightforward process. Here’s what you need to know:

Accessing Form 30

Form 30 is available on the Finance Portal. Once you log in with your profile, some of your details, such as your Tax Identification Number (NIF), will automatically populate.

Required Information

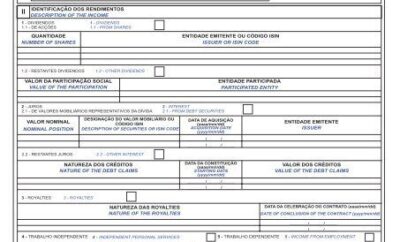

You’ll need to provide specific details, including:

- The year and month the declaration pertains to.

- Indicate whether it’s a first declaration for the period or a replacement for a previously submitted one.

- The nature of the income, in this case, commissions paid to platforms.

- The Portuguese NIF and the tax residence NIF of the platform, the country code of residence, the amount paid to the platform (base value, excluding VAT, as intra-community transactions are not subject to VAT), and the taxation rate.

Important Considerations

It’s essential to have intra-community activities activated on your NIF. Additionally, you should obtain the respective RFI21 and CRF from each platform. This documentation is crucial to ensure that you’re not subject to withholding tax when completing Form 30.

Why Compliance Matters

Staying compliant with tax obligations not only avoids potential fines but also ensures that your AL business operates smoothly. Understanding and correctly managing these requirements can save you time and money, allowing you to focus more on providing excellent service to your guests.

Conclusion

For Local Accommodation owners in Portugal, mastering the submission of Form 30 is a vital part of managing your property’s tax obligations. By following the guidelines and ensuring timely submission, you can maintain compliance with Portuguese tax laws, ultimately contributing to the success and sustainability of your AL business. Remember, staying informed and proactive about your tax obligations is key to navigating the complexities of property management with confidence.